It must be said that the volume of the market, if the rental of apartments is of a private nature, is not calculated exactly, but approximately. Official services keep detailed statistics for the reason that contracts are not certified by a notary. Companies operating in the rental market do the same, as they have their own information base. In other words, not a single company does this, which means that they do not know the true state of the situation in the city. However, some organizations record facilities that customers rent them for a specific period. For example, in the capital, about 8,000 apartments are rented monthly, that is, every year more than a hundred thousand different offers are received. At the same time, the facts that they are rented privately are not taken into account, that is, this or that company does not participate in these processes. The property of the population of Russia, at present, according to the latest calculations, includes various objects — houses and apartments, the approximate number of which is 30,000. But, in spite of everything, the owners rent them out, and they themselves live in a house in the country, for example. So trying to make a profit. They rent them until the facilities are needed. In other words, the owners do not have official profit, which means they do not pay taxes. Most of all they earn when the apartment is rented out by the whole population of the country, without exception, because this segment in the market costs separately. And in principle needs special attention. It happens that such objects are managed not by private owners, but by companies. But if they pay taxes, it is still not clear how much the state would be enriched. It must be said that persons must necessarily register as entrepreneurs in order to then pay taxes according to a simple scheme. However, not all citizens deal with this issue, not because they don’t want to, but for the reason that I don’t know how to do it right. Apparently there is no one to answer some of the questions that have arisen. However, in this system, the actions on the part of the client are simple. For example, there is no need to submit different declarations to services, and count your own profit, write expenses and incomes, for example, and not only. To become an entrepreneur, you need to take out a patent for 12 months. Estimated cost is 6000 rubles. You should learn more about the patent, because there are features associated with the location of the apartment.

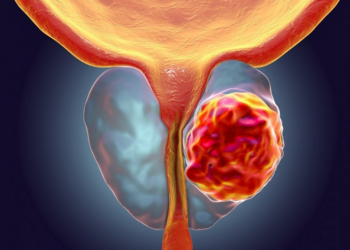

Как выявить рак предстательной железы и первые симптомы

Рак предстательной железы – это злокачественное новообразование, возникающее в предстательной железе, мужской репродуктивной железе, которая находится ниже мочевого пузыря. Рак...